Erase Negatives. Rebuild Fast. Get Back in Control.

Remove collections, charge-offs, late payments & inquiries — fast, legally, and done for you.

This is the credit repair solution that gets real results — not letters that get ignored or subscriptions that drag on for months.

✅ Dispute ALL major negative items with all 3 bureaus

✅ Real-time progress updates

✅ 1:1 onboarding and weekly updates

⚠️ We only take a limited number of clients at once to ensure results.

PRICING

Choose Your Plan

Rapid removal program

$349

All 3 credit bureaus

3 rounds of disputes

Rapid processing (no monthly fees, no dragging it out)

Personal info clean-up included

No contracts - cancel anytime

Want Help But Not Ready for the Full Program?

$99

Monthly Payment Option

Fast turnaround

Great for Data Breach Victims

Great for light reports

No contracts - cancel anytime

For those who want results — and a score to match.

$699

Full 3-bureau disputes (collections, charge-offs, inquiries, late payments)

Aged authorized user account (2–10 years history)

Personal information cleanup

Priority file handling

No contracts - cancel anytime

30 DAYS MONEY BACK GUARANTEE!

We believe in the quality of our products and are committed to your satisfaction. That’s why we offer a 30-Day Money Back Guarantee on all purchases. If you are not completely satisfied with your purchase, simply return it within 30 days for a full refund, no questions asked.

Risk-Free

30-Day Action Guarantee:

If no work is initiated on your file within 30 days of your onboarding, you’ll receive a full refund — no questions asked.

Struggling with your credit?

You’ve paid off debts, disputed accounts, and checked Credit Karma daily… yet nothing seems to change.

You’ve tried credit repair before, but got ghosted after paying

You want funding or approvals — but keep getting denied.

You know errors are on your report — but don’t know how to fight back

Don't worry, we can help!

FAQ

What is the Rapid Removal Program?

The Rapid Removal Program is a done-for-you credit sweep service that challenges negative items across all three bureaus — including collections, charge-offs, late payments, inquiries, and more — with a fast-tracked dispute strategy designed for visible results in as little as 30 days.

What items can you remove?

We target:

Collections (paid & unpaid)

Charge-offs

Late payments

Repossessions

Inquiries

Bankruptcies

Medical bills

Student loans (in some cases)

Results vary, but we pursue everything that’s legally disputable.

How fast will I see results?

Some clients see deletions in as little as 7–14 days, but the average timeframe is 30–45 days. Credit bureaus are legally allowed up to 30 days to respond to disputes and make updates.

Do I need credit monitoring?

Yes. You’ll need access to a 3-bureau credit monitoring platform like IdentityIQ, SmartCredit, or MyScoreIQ so we can pull and analyze your reports. We’ll send you a link to sign up.

What is a tradeline?

A tradeline is a credit account that appears on your report. In this case, we add you as an authorized user (AU) on an aged, high-limit account with perfect payment history. This boosts your credit age, utilization, and payment history — all major score factors.

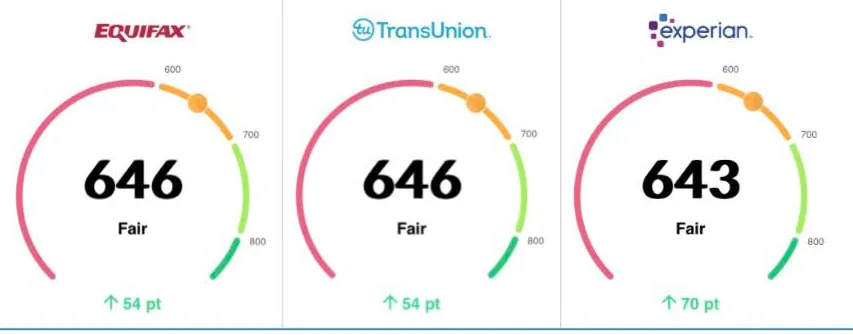

How much can my score increase?

Everyone’s profile is different, but we’ve seen score increases ranging from 30 to 100+ points, depending on your existing credit age, utilization, and negatives. A tradeline won’t fix negatives, but it boosts the positives.